Evolution of Personal Finance Management

From Manual Budgeting to Automated Apps

Personal finance management has evolved significantly. Decades ago, individuals tracked expenses manually using spreadsheets or pen and paper.

This process was time-consuming and often prone to errors.

Introduced in the late 1990s, personal finance software like Microsoft Money and Quicken began to simplify this process by offering digital alternatives to manual tracking.

Automated apps revolutionized the landscape.

Modern finance apps now offer features like automatic expense categorization, real-time balance updates, and personalized financial insights.

For example, apps like:

- Mint

- YNAB (You Need A Budget)

enable users to set budgets, track spending, and receive alerts on overspending—all making hands-on budgeting simpler and more accurate.

Impact of Technology on Personal Finance

Technology has dramatically impacted personal finance.

Through the power of artificial intelligence and machine learning, apps now provide personalized recommendations based on users’ spending habits.

For instance, software can analyze past transactions to suggest how much to save or invest monthly.

Moreover, the adoption of cloud computing allows access to financial data anytime, anywhere. Users can view and manage finances on multiple devices, ensuring real-time synchronization.

Examples include cloud-based services like QuickBooks and FreshBooks, which are crucial for freelancers and small business owners.

Security remains paramount in digital finance.

With advanced encryption methods, most finance apps ensure users’ data protection, reducing the risks associated with online financial management.

Overall, technology fosters more efficient, accurate, and secure personal finance management, making it easier for individuals to achieve financial health.

Key Features of Top Personal Finance Apps

Budget Tracking and Analysis

Budget tracking and analysis are cornerstone features in top personal finance apps. Users can create personalized budgets, categorize expenses, and monitor spending in real time.

Apps like Mint and YNAB analyze spending patterns and provide detailed reports, highlighting areas where users can save.

This functionality helps individuals stay on track with their financial goals and make informed decisions about their money.

Bill Payment and Reminders

Efficient bill tracking is crucial for financial stability.

Many finance apps integrate bill payment and reminder systems to ensure no deadlines are missed.

Users can link their bills directly to the app, set up automatic payments, and receive notifications for upcoming due dates.

This feature not only helps avoid late fees but also keeps credit scores intact by ensuring timely payments.

Investment and Savings Tools

Top personal finance apps offer robust tools for investment and savings management.

Apps like:

- Acorns

- Stash

allow users to invest spare change or small sums into diversified portfolios, making investing accessible to everyone.

Savings tools enable goal setting and track progress, helping users build emergency funds or save for big purchases.

By automating investments and savings, these apps empower users to grow their wealth effortlessly and achieve long-term financial aspirations.

Benefits of Using Personal Finance Apps

1. Convenience and Accessibility

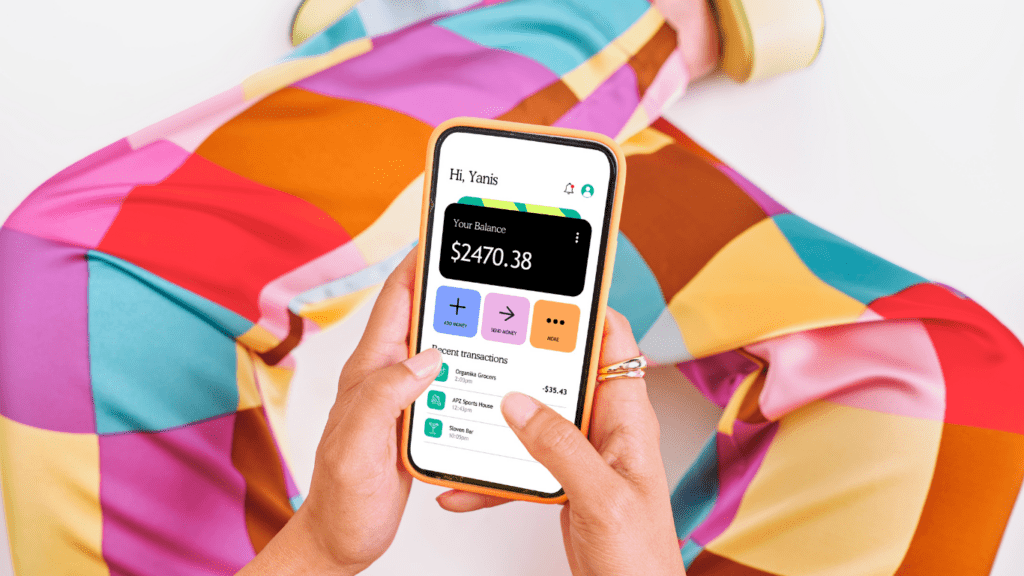

Using personal finance apps offers unmatched convenience and accessibility.

I access my financial data anytime, anywhere, using my smartphone or tablet.

These apps (e.g., Mint, YNAB) eliminate the need to manually input transactions or keep physical records.

By connecting directly to my bank accounts and credit cards, they automatically update my transactions and balances.

This seamless integration ensures I always have up-to-date information at my fingertips, saving time and effort.

2. Improved Financial Literacy

Personal finance apps significantly enhance my financial literacy.

Through detailed reports and visualizations, these apps help me understand my spending habits and identify areas for improvement.

Features like educational articles, tips, and budgeting advice provide valuable knowledge on managing money effectively.

With this information, I make informed decisions and develop better financial habits, ultimately achieving greater control over my finances.

3. Real-Time Financial Insights

Real-time financial insights are one of the most valuable aspects of personal finance apps.

These insights allow me to monitor my spending patterns, track my budget, and receive notifications for unusual activity or upcoming bills.

By providing instant updates and alerts, I avoid overspending, stay within my budget, and ensure timely bill payments.

Additionally, these apps offer personalized financial recommendations based on my spending behavior, helping me optimize my saving and investment strategies.

Challenges and Considerations

Security Concerns

Personal finance apps deal with sensitive information, including bank account details and transaction histories. Users worry about data breaches and hacking attempts.

These risks emphasize the need for robust security measures, such as encryption and two-factor authentication.

While most apps provide these protections, scrutinizing their security policies remains essential.

The Federal Trade Commission (FTC) highlights the importance of safeguarding personal data, urging users to choose apps from reputable companies.

Accuracy of Financial Advice

The personalized advice offered by finance apps can significantly impact users’ financial decisions.

However, inaccuracies may arise due to outdated information or algorithmic errors.

While these apps analyze past data, unpredictable financial developments can affect their advisories. Trusting such recommendations without cross-verifying with other sources could lead to suboptimal choices.

According to the Consumer Financial Protection Bureau (CFPB), verifying crucial financial advice with certified professionals can mitigate these risks.

Integration with Financial Institutions

Effective integration with banks and credit unions determines the app’s utility.

Some users face connectivity issues or delays in transaction updates, disrupting budget tracking and financial planning.

Ensuring compatibility between an app and the bank’s systems is crucial.

According to a report by Javelin Strategy & Research, about 50% of users experience integration issues, highlighting the importance of choosing apps known for seamless connectivity.

Regular updates from app developers can resolve many of these challenges, ensuring more reliable service.